Condominiums are expected to see the largest price jump as more people get priced out of single-family detached housing, said a Calgary real estate agent

Article content

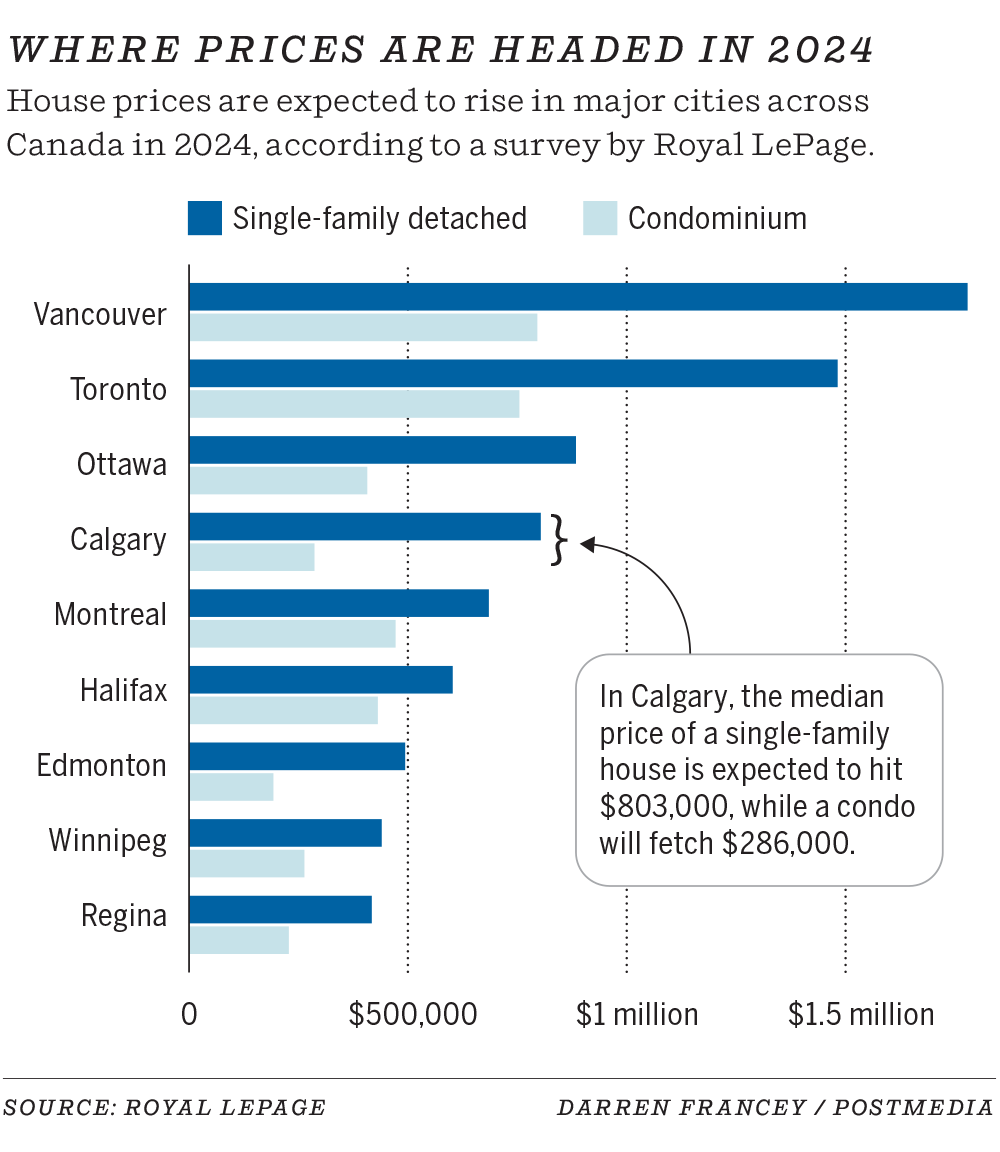

Housing prices in Calgary are projected to climb the fastest among all major Canadian cities in 2024, with a hotter market projected if interest rates drop by mid-year, a new report says.

Overall, the aggregate price of a home in Calgary is forecast to jump eight per cent year-over-year by the end of 2024, according to Royal LePage’s 2024 market report.

Article content

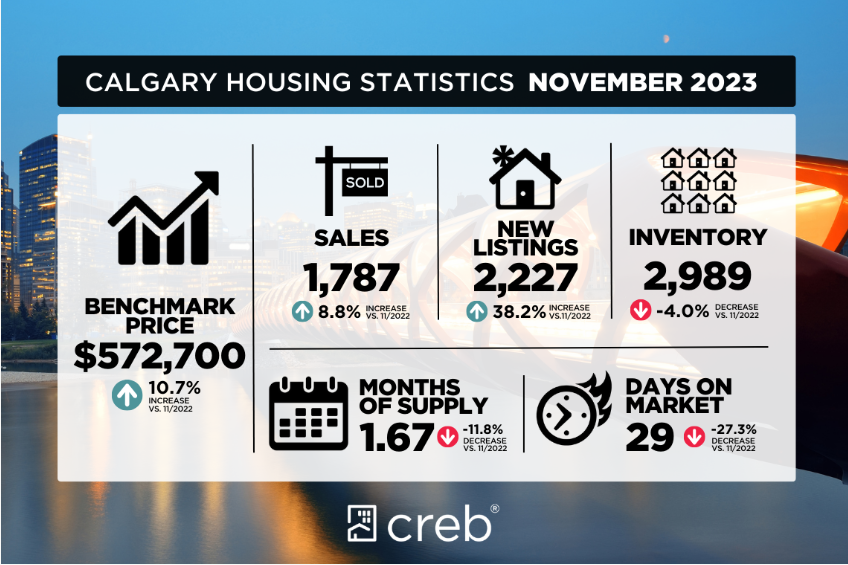

The projections come as the latest Calgary Real Estate Board (CREB) data show the city’s benchmark price has risen 10.7 per cent since November 2022, with months of supply and inventory falling.

Advertisement 2

Article content

That would bring the aggregate home price in Calgary to $711,612. As of November, the benchmark price was $572,700, according to CREB.

Calgary ‘bucking’ national trends

The projected increase falls in line with those seen over the past two to three years, Corinne Lyall, broker and owner of Royal LePage Benchmark, said in an interview.

“A more balanced, kind of healthy market, would be between three and five per cent a year — and so it’s double that,” she said. “But saying that, we’re certainly nowhere near some of the markets like Vancouver and Toronto that experience 20 per cent year over year.”

Calgary’s real estate market has “bucked the trend,” the report notes, as it continues on its upward price trajectory.

Condominiums are expected to see the largest price jump, projected to increase 9.5 per cent by the end of the year to $286,562. Meanwhile the median price of a single-family detached house is expected to rise six per cent to $803,692.

The rising price of condominiums is largely a downstream effect of more people being priced out of single-family detached houses, Lyall said.

Article content

Advertisement 3

Article content

That’s had a substantial effect on prices in the downtown, which are hitting levels not seen since 2014 before the 2015-16 recession, she added. That recession hit the condo market particularly hard, and only now is it starting to show strength.

“(The recession) impacted the whole real estate market, but specifically the condo market because if people can afford to buy a residence . . . they’re more likely to do that than go to condos.”

If the Bank of Canada begins to drop interest rates by mid-year — a scenario predicted in ATB Financial’s latest economic outlook report for Alberta, if core inflation drops to two per cent year over year — buyers will be motivated to jump into the market, Lyall said.

Related Stories

-

Posthaste: Get ready for the 'great adjustment' in Canada's housing market

-

City will lease two pieces of land for temporary, modular housing for vulnerable families

-

hort-term rentals have ’significantly impacted’ housing affordability: Desjardins

-

Canmore recreational housing prices buck trend, average $1.7M for detached home

That will likely make for a slow start to 2024, she added, but by March she expects the spring market to take off — a seasonal trend the housing market experiences most years.

Advertisement 4

Article content

While interprovincial migration has slowed down after the city saw a record-breaking influx of new residents, investors from other provinces are continuing to drive demand for multi-family homes, she said.

Fellow major cities expected to increase at modest rates

Calgary’s aggregate increases are notably higher than many other Canadian cities.

However, Calgary also hasn’t experienced the same tumult cities such as Toronto witnessed over the pandemic. Home prices in the Greater Toronto Area are projected to rise six per cent ($1,198,012), while prices in Greater Vancouver are forecast to increase three per cent ($1,281,732).

Activity in those markets have generally slowed this year. Transactions have declined as much as 20 to 30 per cent in some regions, Royal LePage’s report noted, as buyers wait for rates to drop.

Cooler housing markets has potentially stemmed the flow of interprovincial migrants, Lyall said, with potential buyers feeling slightly less intimidated by their local markets.

“It’s made it a little more affordable for them to want to stay if they can — so (now) it’s just the people that are really motivated to want to move to Alberta and Calgary, and maybe raise a family and be able to potentially buy a bigger home than they could in those markets.”

Article content

https://news.google.com/rss/articles/CBMiY2h0dHBzOi8vY2FsZ2FyeWhlcmFsZC5jb20vYnVzaW5lc3MvcmVhbC1lc3RhdGUvY2FsZ2FyeS1ob3VzaW5nLXByaWNlcy1wcm9qZWN0ZWQtdG8tY2xpbWItOC1wZXItY2VudNIBAA?oc=5

2023-12-14 19:57:49Z

CBMiY2h0dHBzOi8vY2FsZ2FyeWhlcmFsZC5jb20vYnVzaW5lc3MvcmVhbC1lc3RhdGUvY2FsZ2FyeS1ob3VzaW5nLXByaWNlcy1wcm9qZWN0ZWQtdG8tY2xpbWItOC1wZXItY2VudNIBAA

Comments