A trade truce would help

Easy money to the rescue

Are consumers too divided to agree on a recession?

Best economy ever? Not exactly

https://www.cnn.com/2019/10/31/investing/economy-recession-slowdown/index.html

2019-10-31 11:17:54Z

52780421458907

A Jeep Renegade 4x4 e is presented at the Geneva Motor Show March 5, 2019. Signage in the background says"'FCA Fiat Chrysler Automobiles," to which Jeep belongs.

Uli Deck | picture alliance | Getty Images

Peugeot (PSA) and Fiat Chrysler (FCA) confirmed their intention to merge on Thursday, in what would be a 50-50 share swap and create the world's fourth-largest carmaker.

The new company's shares will be listed in New York, Paris and Milan with FCA's John Elkann becoming the chairman and Peugeot's Carlos Tavares becoming the CEO.

"Discussions have opened a path to the creation of a new group with global scale and resources owned 50% by Groupe PSA shareholders and 50% by FCA shareholders," they said in a statement on Thursday morning.

"In a rapidly changing environment, with new challenges in connected, electrified, shared and autonomous mobility, the combined entity would leverage its strong global R&D (research and development) footprint and ecosystem to foster innovation and meet these challenges with speed and capital efficiency."

Early reports of the merger talks — which would create a new group worth roughly $50 billion — have moved share prices for both automakers this week. Fiat Chrysler stock surged as much as 8% on Tuesday and added another 5% on Wednesday.

The PSA board has already approved the merger and the Fiat Chrysler board met on Wednesday. Executives have briefed regulators in the U.S. and France, the Wall Street Journal reported, citing unnamed sources.

The confirmation of the deal comes about five months after Fiat Chrysler ended merger discussions with PSA's French rival, Renault. However, this new merger is unlikely to face the same interference from the French government with some positive comments already emanating from Paris.

—CNBC's Michael Wayland and Phil LeBeau contributed to this article.

A Jeep Renegade 4x4 e is presented at the Geneva Motor Show March 5, 2019. Signage in the background says"'FCA Fiat Chrysler Automobiles," to which Jeep belongs.

Uli Deck | picture alliance | Getty Images

Peugeot (PSA) and Fiat Chrysler (FCA) confirmed their intention to merge on Thursday, in what would be a 50-50 share swap and create the world's fourth-largest carmaker.

The new company's shares will be listed in New York, Paris and Milan with FCA's John Elkann becoming the chairman and Peugeot's Carlos Tavares becoming the CEO.

"Discussions have opened a path to the creation of a new group with global scale and resources owned 50% by Groupe PSA shareholders and 50% by FCA shareholders," they said in a statement.

"In a rapidly changing environment, with new challenges in connected, electrified, shared and autonomous mobility, the combined entity would leverage its strong global R&D footprint and ecosystem to foster innovation and meet these challenges with speed and capital efficiency."

The PSA board approved the merger and the Fiat Chrysler board met Wednesday. Executives have briefed regulators in the U.S. and France, the Wall Street Journal reported, citing unnamed sources.

Reports of the talks, including a potential "all-share merger of equals," as the Wall Street Journal first reported, sent shares of Fiat Chrysler surging as much as 8% on Tuesday. The stock rose by less than 2% in midday trading Wednesday.

The confirmation of the deal comes about five months after Fiat Chrysler ended merger discussions with PSA's French rival, Renault. However, this new merger is unlikely to face the same interference from the French government, a source told CNBC.

—CNBC's Michael Wayland and Phil LeBeau contributed to this article.

Check out the companies making headlines before the bell:

General Electric – General Electric reported quarterly profit of 15 cents per share, 4 cents a share above estimates. Revenue also exceeded forecasts and GE raised its full-year cash flow forecast.

Yum Brands – Yum earned an adjusted 80 cents per share for its latest quarter, 14 cents a share shy of consensus forecasts. Revenue also came in below estimates, hurt by a weaker-than-expected performance at its Pizza Hut and KFC units.

Anixter International – The software company agreed to be acquired by private-equity firm Clayton, Dubilier & Rice for $81 per share in cash. The total value of the deal is $3.8 billion including assumed debt, with the transaction expected to close by the end of 2020's first quarter.

Molson Coors – The beer brewer fell a penny a share short of estimates, with quarterly profit of $1.48 per share. Revenue also came in short of forecasts and Molson Coors announced a restructuring that will slash up to 500 jobs.

Garmin – The GPS and fitness device maker earned $1.19 per share for its latest quarter, well above the 95 cents a share consensus estimate. Revenue also topped forecasts. Garmin saw better-than-expected results in all its units, as well as higher-than-expected profit margins.

Tupperware – Tupperware earned an adjusted 43 cents per share, well short of the 62 cents a share consensus estimate. The housewares maker's revenue also came in short of forecasts. The company said it was experiencing challenging trends in markets like the U.S., China, Canada, and Brazil. Tupperware also cut its full-year earnings outlook.

Johnson & Johnson – J&J said its testing found no asbestos in its Johnson's Baby Powder. That testing included a single bottle that the Food and Drug Administration had said contained trace amounts of asbestos, prompting J&J to recall a lot of 33,000 bottles earlier this month.

Fiat Chrysler – Fiat Chrysler said it was in talks about a possible merger with Peugeot maker PSA that could create a combined company worth about $50 billion. Fiat Chrysler had abandoned talks earlier this year to merge with France's Renault.

Amgen – Amgen reported quarterly profit of $3.66 per share, 13 cents a share above estimates. The biotech company's revenue also beat forecasts and Amgen raised its full-year guidance amid strong sales of its biosimilar drugs.

Electronic Arts – Electronic Arts reported quarterly profit of 96 cents per share, 10 cents a share above estimates. The video game maker's revenue also topped estimates. Electronic Arts saw stronger digital sales, including game downloads and in-game purchases.

Mattel – Mattel came in 10 cents a share above estimates, with quarterly profit of 26 cents per share. The toy maker's revenue was slightly above Wall Street forecasts. Mattel also said it is restating some past earnings following an internal investigation into accounting issues, and the company's chief financial officer is resigning.

Mondelez International – Mondelez reported quarterly profit of 64 cents per share, 4 cents a share above estimates. Revenue was slightly above forecasts. The snack maker raised its full-year outlook, as sales volume increases across its major markets.

FireEye – FireEye raised its annual revenue guidance, after doubling estimates by reporting quarterly profit of 2 cents per share. The cybersecurity company's revenue also beat forecasts as it sold more cloud subscriptions.

Advanced Micro Devices – AMD reported adjusted earnings of 18 cents per share, in line with Street forecasts. Revenue was very slightly below estimates, although the chipmaker reported better-than-expected results for its data center business.

Yum China – Yum China beat analyst estimates by 3 cents A share, with quarterly profit of 58 cents per share. The restaurant operator's revenue was below forecasts, however, as were comparable-restaurant sales at KFC, Pizza Hut, and Taco Bell.

Sony – Sony reported its best-ever second-quarter profit, driven by strong sales of its image sensors. Sales helped offset a drop in earnings from Sony's gaming division.

Edison International – Edison's Southern California Edison unit said its equipment will likely be found to have been associated with a 2018 California wildfire that damaged more than 1,000 homes in Los Angeles and Ventura counties.

PSA Group, the French owner of Peugeot, is exploring a merger with its US-Italian rival Fiat Chrysler, it has confirmed.

A deal between the two carmakers would create a business with a combined market value of nearly $50bn (£39.9bn).

This is Fiat Chrysler's second attempt at a merger this year after it pulled out of an agreement with Renault in June.

Fiat Chrysler shares jumped 7.5% on Wall Street.

The potential merger would face significant political and financial hurdles.

Discussions remain in the early stages and there is no guarantee of a final deal.

However, if the two companies do combine, PSA chief executive Carlos Tavares is expected to lead the enlarged group.

John Elkann, Fiat Chrysler's chairman and the head of Italy's Agnelli industrial dynasty which controls the business, would retain the same position at the new company.

A merger of the two groups would bring a number of brands under one roof including Alfa Romeo, Citroen, Jeep, Opel, Peugeot and Vauxhall.

The talks come months after a proposed tie-up between Fiat Chrysler and French carmaker Renault collapsed.

Fiat Chrysler had described its bid for Renault as a "transformative" proposal that would create a global automotive leader.

Industry shifts toward electric models, along with stricter emissions standards and the development of new technologies for autonomous vehicles, have put increasing pressure on carmakers to consolidate.

PSA Group, the French owner of Peugeot, is exploring a merger with its US-Italian rival Fiat Chrysler, it has confirmed.

A deal between the two carmakers would create a business with a combined market value of nearly $50bn (£39.9bn).

This is Fiat Chrysler's second attempt at a merger this year after it pulled out of an agreement with Renault in June.

Fiat Chrysler shares jumped 7.5% on Wall Street.

The potential merger would face significant political and financial hurdles.

Discussions remain in the early stages and there is no guarantee of a final deal.

However, if the two companies do combine, PSA chief executive Carlos Tavares is expected to lead the enlarged group.

John Elkann, Fiat Chrysler's chairman and the head of Italy's Agnelli industrial dynasty which controls the business, would retain the same position at the new company.

A merger of the two groups would bring a number of brands under one roof including Alfa Romeo, Citroen, Jeep, Opel, Peugeot and Vauxhall.

The talks come months after a proposed tie-up between Fiat Chrysler and French carmaker Renault collapsed.

Fiat Chrysler had described its bid for Renault as a "transformative" proposal that would create a global automotive leader.

Industry shifts toward electric models, along with stricter emissions standards and the development of new technologies for autonomous vehicles, have put increasing pressure on carmakers to consolidate.

PSA Group, the French owner of Peugeot, is exploring a merger with its US-Italian rival Fiat Chrysler, it has confirmed.

A deal between the two carmakers would create a business with a combined market value of nearly $50bn (£39.9bn).

This is Fiat Chrysler's second attempt at a merger this year after it pulled out of an agreement with Renault in June.

Fiat Chrysler shares jumped 7.5% on Wall Street.

The potential merger would face significant political and financial hurdles.

Discussions remain in the early stages and there is no guarantee of a final deal.

However, if the two companies do combine, PSA chief executive Carlos Tavares is expected to lead the enlarged group.

John Elkann, Fiat Chrysler's chairman and the head of Italy's Agnelli industrial dynasty which controls the business, would retain the same position at the new company.

A merger of the two groups would bring a number of brands under one roof including Alfa Romeo, Citroen, Jeep, Opel, Peugeot and Vauxhall.

The talks come months after a proposed tie-up between Fiat Chrysler and French carmaker Renault collapsed.

Fiat Chrysler had described its bid for Renault as a "transformative" proposal that would create a global automotive leader.

Industry shifts toward electric models, along with stricter emissions standards and the development of new technologies for autonomous vehicles, have put increasing pressure on carmakers to consolidate.

PSA Group, the French owner of Peugeot, is exploring a merger with its US-Italian rival Fiat Chrysler, it has confirmed.

A deal between the two carmakers would create a business with a combined market value of nearly $50bn (£39.9bn).

This is Fiat Chrysler's second attempt at a merger this year after it pulled out of an agreement with Renault in June.

Fiat Chrysler shares jumped 7.5% on Wall Street.

The potential merger would face significant political and financial hurdles.

Discussions remain in the early stages and there is no guarantee of a final deal.

However, if the two companies do combine, PSA chief executive Carlos Tavares is expected to lead the enlarged group.

John Elkann, Fiat Chrysler's chairman and the head of Italy's Agnelli industrial dynasty which controls the business, would retain the same position at the new company.

A merger of the two groups would bring a number of brands under one roof including Alfa Romeo, Citroen, Jeep, Opel, Peugeot and Vauxhall.

The talks come months after a proposed tie-up between Fiat Chrysler and French carmaker Renault collapsed.

Fiat Chrysler had described its bid for Renault as a "transformative" proposal that would create a global automotive leader.

Industry shifts toward electric models, along with stricter emissions standards and the development of new technologies for autonomous vehicles, have put increasing pressure on carmakers to consolidate.

PSA Group, the French owner of Peugeot, is exploring a merger with its US-Italian rival Fiat Chrysler, it has confirmed.

A deal between the two carmakers would create a business with a combined market value of nearly $50bn (£39.9bn).

This is Fiat Chrysler's second attempt at a merger this year after it pulled out of an agreement with Renault in June.

Fiat Chrysler shares jumped 7.5% on Wall Street.

The potential merger would face significant political and financial hurdles.

Discussions remain in the early stages and there is no guarantee of a final deal.

However, if the two companies do combine, PSA chief executive Carlos Tavares is expected to lead the enlarged group.

John Elkann, Fiat Chrysler's chairman and the head of Italy's Agnelli industrial dynasty which controls the business, would retain the same position at the new company.

A merger of the two groups would bring a number of brands under one roof including Alfa Romeo, Citroen, Jeep, Opel, Peugeot and Vauxhall.

The talks come months after a proposed tie-up between Fiat Chrysler and French carmaker Renault collapsed.

Fiat Chrysler had described its bid for Renault as a "transformative" proposal that would create a global automotive leader.

Industry shifts toward electric models, along with stricter emissions standards and the development of new technologies for autonomous vehicles, have put increasing pressure on carmakers to consolidate.

Facebook-owned WhatsApp has filed a lawsuit against Israel's NSO Group, alleging the firm was behind cyber-attacks that infected devices with malicious software.

WhatsApp accuses the company of sending malware to roughly 1,400 mobile phones for the purposes of surveillance.

Users affected included journalists, human rights activists, political dissidents, and diplomats.

NSO Group, which makes software for surveillance, disputed the allegations.

In a court filing, WhatsApp said NSO Group "developed their malware in order to access messages and other communications after they were decrypted on target devices".

It said NSO Group created various WhatsApp accounts and caused the malicious code to be transmitted over the WhatsApp servers in April and May.

"We believe this attack targeted at least 100 members of civil society, which is an unmistakable pattern of abuse," WhatsApp said in a statement.

The affected users had numbers from several countries, including Bahrain, the United Arab Emirates and Mexico, according to the lawsuit.

WhatsApp said it is seeking a permanent injunction banning NSO from using its service.

The firm, which was acquired by Facebook in 2014, said it was the first time an encrypted messaging provider had taken legal action of this kind.

WhatsApp promotes itself as a "secure" communications app because messages are end-to-end encrypted. This means they should only be displayed in a legible form on the sender or recipient's device.

NSO Group said it would fight the allegations.

"In the strongest possible terms, we dispute today's allegations and will vigorously fight them," the company said in a statement to the BBC.

"The sole purpose of NSO is to provide technology to licensed government intelligence and law enforcement agencies to help them fight terrorism and serious crime."

(Bloomberg) -- European stocks slipped with S&P 500 Index futures as investors awaited a possible Federal Reserve interest-rate cut and some of the season’s biggest corporate earnings, including from Apple and Facebook. Treasuries and German bunds edged higher.

The Stoxx Europe 600 Index declined after six straight sessions of gains, led lower by telecoms. Contracts on the S&P 500 drifted lower, a day after the U.S. equity benchmark hit a record. Japan’s Topix benchmark closed at a 2019 high, while trading elsewhere in Asia was mixed, with equities dropping in Hong Kong and Shanghai, where a warning against speculation on blockchain-related stocks depressed trading.

Yields on Japanese 10-year bonds hit the highest since June and their Australian counterparts jumped almost nine basis points, while peers in the U.S. and Germany halted a surge that’s lasted several days.

Investors are struggling to find fresh impetus to extend the record-breaking rally in U.S. stocks. Optimism on the China trade front from President Donald Trump is aiding the bull case, and an anticipated Fed rate cut on Wednesday may add further fuel. Still, recent data has come in mixed and while corporate earnings are topping estimates on average, the bar has been set low.

“What we’ve had happening in markets in the last few weeks is a lifting of that perceived uncertainty” about U.S.-China trade and Brexit, with central bank easing providing a lift, Sue Trinh, a global macro strategist at Manulife Investment Management, told Bloomberg TV. “The real risk is that we’re seeing a boost to asset prices but no real uptick in the real economy,” she said.

Meanwhile, the pound weakened as U.K. Prime Minister Boris Johnson said he’ll keep pushing for an early election despite failing for a third time to trigger a snap poll. In metals, spot palladium slipped after a record close Monday.

Here are some key events coming up this week:

Earnings include: Pfizer on Tuesday; Airbus, Apple, Credit Suisse, Facebook and PetroChina on Wednesday; Mitsubishi Heavy on Thursday; Exxon Mobil and Macquarie Group on Friday.The Fed is expected to lower the main interest rate when policy makers decide on Wednesday. U.S. economic growth is forecast to have slowed to 1.6% in the third quarter. GDP data are due Wednesday. The Fed’s preferred inflation metric, the core PCE deflator, is due Thursday.The Bank of Japan sets policy on Thursday and Governor Haruhiko Kuroda will hold a news conference.Friday brings the monthly U.S. non-farm payrolls report.

These are some of the main moves in markets:

Stocks

The Stoxx Europe 600 Index sank 0.5% as of 9:29 a.m. London time.Futures on the S&P 500 Index fell 0.1%.Japan’s Topix index climbed 0.9%.The MSCI Asia Pacific Index climbed 0.5%.

Currencies

The Bloomberg Dollar Spot Index gained 0.1%.The pound weakened 0.2% to 86.484 pence per euro.The euro decreased 0.2% to $1.108.The South Korean Won strengthened 0.6% to 1,163.19 per dollar.

Bonds

The yield on 10-year Treasuries declined one basis point to 1.83%.Britain’s 10-year yield decreased three basis points to 0.689%.Germany’s 10-year yield fell two basis points to -0.35%.Australia’s 10-year yield jumped nine basis points to 1.1855%.

Commodities

The Bloomberg Commodity Index was little changed.Gold rose 0.1% to $1,493.89 an ounce.West Texas Intermediate crude decreased 0.8% to $55.34 a barrel.

--With assistance from Andreea Papuc, Tian Chen and Livia Yap.

To contact the reporter on this story: Todd White in Madrid at twhite2@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, ;Samuel Potter at spotter33@bloomberg.net, Yakob Peterseil

For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L.P.

WASHINGTON (Reuters) - In the midst of what became a golden decade for the U.S. Federal Reserve, central bankers twice in the 1990s cut interest rates in short bursts that managed to help the U.S. economy continue growing despite slowing investment and weak growth overseas.

FILE PHOTO: Federal Reserve Board building on Constitution Avenue is pictured in Washington, U.S., March 19, 2019. REUTERS/Leah Millis

Today’s Fed hopes a third time proves just as charmed.

In their latest two-day policy meeting this week, Fed officials look set to nudge the economy along in similar fashion with their third consecutive rate cut. That would match the moves made by then-Fed Chairman Alan Greenspan in 1995 and 1998 during an era known as “the Great Moderation” for its steady growth, falling unemployment and tempered inflation.

There’s been no clear commitment to another reduction in borrowing costs from Fed policymakers, though a failure to lower rates on Wednesday could risk upending financial markets that are confident another cut is coming. With billions of dollars in bets on futures markets tied to anticipated Fed actions, any deviation by the U.S. central bank from the expected course typically leads to sharp swings in bond and stock markets.

A rate cut on Wednesday, which would be the Fed’s third this year, would lower the overnight benchmark lending rate to a new range of between 1.5% and 1.75%. Policymakers may emphasize that “the three cuts cumulatively have served to balance the risks to the outlook,” and will likely keep the economy on track, JP Morgan economist Michael Feroli wrote last week.

The Fed is scheduled to announce its latest policy decision at 2 p.m. EDT on Wednesday (1800 GMT). Fed Chair Jerome Powell will hold a news conference half an hour later.

Policymakers likely won’t shut the door to further action, but may “communicate patience in deciding future policy moves,” TD Securities analysts wrote last week.

Investors have no firm opinion on when the Fed will move again after Wednesday, a signal to Powell and his colleagues that if they deliver the expected cut this week they will have room to shape market expectations moving forward.

According to CME Group's FedWatch tool here the probability of a rate reduction on Wednesday stands at 94%. After that, however, it's a coin toss whether there will be any further change for at least a year.

That in itself is a success for Powell. Beginning last fall, the Fed confronted a widening gap between what policymakers at that point thought would be continued rate hikes, and the expectations of investors who began factoring rate cuts into their outlook as a global economic slowdown took hold around the intensifying U.S.-China trade war.

The Fed, under pressure to lower rates from President Donald Trump but also watching U.S. investment and manufacturing data weaken, reversed course early this year.

Financial markets have responded with largely easier borrowing conditions, and lower rates on important benchmarks like 30-year home mortgages. Key aspects of the bond market, watched by some Fed officials as evidence of faith or lack of it in near-term economic growth, have been looking steadily healthier.

Some of the ongoing problems like the trade war with China and the prospect of a disorderly British exit from the European Union also have lightened, at least a bit.

That has helped narrow the gap between the Fed and global market expectations.

It may have helped narrow gaps within the U.S. central bank as well. Even those Fed officials who have been most eager to cut rates now feel that one more quarter-percentage-point reduction should be adequate for the year.

Today’s circumstances share a number of similarities with those confronting the Fed roughly a quarter of a century ago.

In July 1995, Fed officials, as now, debated whether slower-than-expected growth would impair business investment, spilling over into hiring plans and, ultimately, household spending.

Just as weak growth in Europe is seen as a risk for U.S. companies today, a weak outlook for Canada and Japan was a concern then, according to minutes of the meeting at which the Fed adopted the first of three rate cuts in six months.

“During the last six weeks my optimism has diminished,” said former Fed Chair Janet Yellen, who was president of the San Francisco Fed at the time. Without action by the Fed “we could easily end up, I think, in an extended growth recession.”

Fast-forward to the present, and again the economic data has not been great.

The most recent jobs and retail sales reports were both weak. Economists polled by Reuters expect economic growth slowed in the third quarter to an annual rate of 1.7%, from a 2% pace in the second quarter. The advance estimate of gross domestic product is due to be released on Wednesday, before the Fed concludes its policy meeting.

As the 1990s proceeded, it took two such rounds of “mid-cycle adjustment,” about two years apart and each involving three rate cuts of a quarter of a percentage point each, to keep that recovery on track. It was derailed by the bursting of the dot-com stock market bubble, with a recession starting in March, 2001.

The expansion since the 2007-2009 financial crisis and recession has already eclipsed the 1990s to become the most prolonged period of sustained growth in U.S. history.

While the pace has sometimes been tepid, Powell and his colleagues argue there is no reason it can’t keep going, and have pledged to act “as appropriate” to try to make it so.

At a speech in Denver earlier this month, Powell nodded to both the risks facing the U.S. economy, but also to its ongoing growth.

On balance, “this feels very sustainable,” he said.

Graphic: Back to the 90s, here

Reporting by Howard Schneider; Editing by Dan Burns and Paul Simao

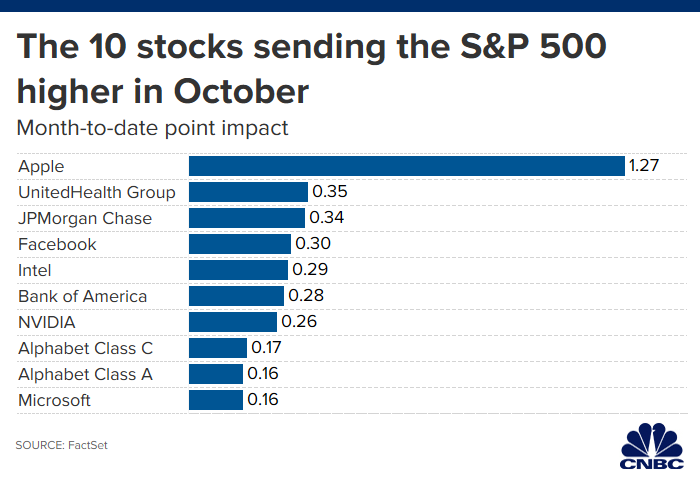

The S&P 500 hit a new record high on Monday, as strong performances by technology and bank stocks have sent the index climbing this month.

Heavily-weighted Apple has been the biggest contributor to the S&P 500 in October by a long shot, as shares of Apple are up 10.1% this month, contributing 1.27 points alone to the S&P 500's October gain because of its large size. The S&P 500 is up more than 2%, or more than 45 points, this month to 3022.55 through Friday.

UnitedHealth and J.P. Morgan Chase were the second and third biggest contributors on the index for the month, climbing 13.8% and 7.1% respectively.

October's top 10 contributors to the S&P 500 are largely rounded out by other tech companies and banks: Facebook, Intel, Bank of America, Nvidia, Google-parent Alphabet, Microsoft and Biogen.

Bank stocks have benefited from a recent rebound in bond yields, while many of the technology stocks have gotten relief from optimism about trade negotiations in China. Companies like Apple and Nvidia have significant exposure to the trade war with China through supply chains and sales. Investors are also growing optimistic about Apple's iPhone sales. Apple reports earnings on Wednesday.

J.P. Morgan shares hit an all-time high on Friday, leading a pack of stocks setting records at the end of last week. Bank of America's stock hit its highest level since October 2018, while Western Union shares rose to levels not seen since September 2008.

Charter Communications, O'Reilly Auto, Illinois Tool Works and Sherwin Williams are a few other stocks that reached all-time highs on Friday. Both Phillips 66 and Valero traded at levels not seen since October last year.