Shopify Inc. defied market expectations once again in the third quarter, posting stronger-than-expected results as the global pandemic continued to push shoppers out of bricks-and-mortar stores and onto online platforms.

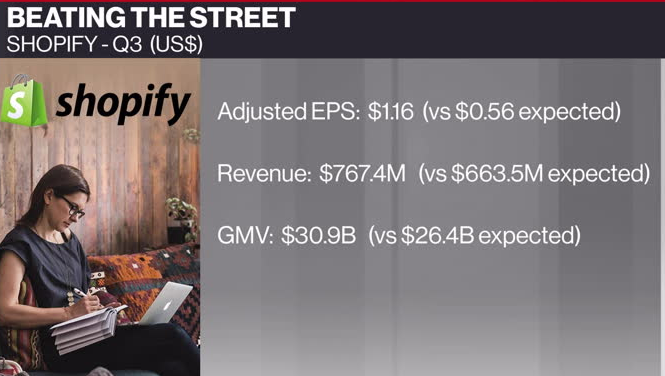

Revenue at Canada’s largest company by stock market value nearly doubled to US$767.4 million while adjusted earnings were US$1.13 per share, more than twice analysts’ estimates of 52 cents.

“The accelerated shift to digital commerce triggered by COVID-19 is continuing, as more consumers shop online and entrepreneurs step up to meet demand,” Shopify President Harley Finkelstein said in the earnings statement.

Key Insights

-Gross merchandise volume -- a measure of product sales flowing through its platform -- was US$30.9 billion, an increase of 109 per cent over the third quarter of last year, reflecting strong e-commerce spending by consumers.

-The company continued to gain traction in new services it offers to customers. Shopify said 51 per cent of eligible merchants in the U.S. and Canada used Shopify Shipping in the third quarter of 2020, versus 45 per cent in the third quarter of 2019.

-Its lending business is growing as well. Merchants in the U.S., Canada and the U.K. received $252.1 million in merchant cash advances and loans from Shopify Capital in the quarter, an increase of 79 per cent from the amount received by U.S. merchants in the same quarter last year.

-The company expects its model to remain popular with buyers and sellers in the pandemic but cited macro risks in its decision not to provide fourth quarter or full-year guidance.

“These include unemployment, fiscal stimulus, and the magnitude and duration of the COVID-19 pandemic, all of which may impact new shop creation on our platform and consumer spending”: Shopify

Shopify shares were up 2.9 per cent in pre-market trading at 7:52 a.m. in New York. The stock is up more than 680 per cent in the past two years and had nearly tripled since the March low, as of Wednesday’s close, as the pandemic accelerated the push by retailers and small businesses to move sales online.

Founded in 2004, the Ottawa-based firm’s core business is helping retailers get online quickly and cheaply. But it has expanded to offer an ever-widening suite of services, including lending, payments and shipping solutions. With a market capitalization of almost US$125 billion, the company is now Canada’s largest publicly traded company.

https://news.google.com/__i/rss/rd/articles/CBMiXWh0dHBzOi8vd3d3LmJubmJsb29tYmVyZy5jYS9zaG9waWZ5LXJhbGxpZXMtYWZ0ZXItY3J1c2hpbmctcmV2ZW51ZS1wcm9maXQtZXN0aW1hdGVzLTEuMTUxNDc2MdIBAA?oc=5

2020-10-29 12:03:37Z

CBMiXWh0dHBzOi8vd3d3LmJubmJsb29tYmVyZy5jYS9zaG9waWZ5LXJhbGxpZXMtYWZ0ZXItY3J1c2hpbmctcmV2ZW51ZS1wcm9maXQtZXN0aW1hdGVzLTEuMTUxNDc2MdIBAA

Tidak ada komentar:

Posting Komentar