Senin, 31 Oktober 2022

Employees of Chinese iPhone producer Foxconn leave factory over COVID restrictions | DW News - DW News

https://news.google.com/__i/rss/rd/articles/CBMiK2h0dHBzOi8vd3d3LnlvdXR1YmUuY29tL3dhdGNoP3Y9MEwtVVl6bjUtMEHSAQA?oc=5

2022-10-31 16:53:44Z

1613091283

Stellantis' joint venture in China is filing for bankruptcy - CNN

Stellantis said that shareholders of its loss-making joint venture producing Jeep vehicles in China have approved it to file for bankruptcy.

The European carmaker said in a statement it had fully impaired the value of its investment in the venture in its results for the fist half of 2022, adding that it will continue to provide services to existing and future Jeep brand customers in China.

Stellantis had terminated the joint venture with Guangzhou Automobile Group Co (GAC) in July, only months after it said it would raise its stake in the business to 75% from 50%.

In the following days, GAC hit out at Stellantis, saying that it was “deeply shocked” by critical comments from Stellantis about the end of their joint venture in China.

While reporting financial results in July, Stellantis Chief Executive Officer Carlos Tavares said over the last five years “the political influence” in doing business with its partners in China was growing by the day. He also added that he did not see a major long-term impact from the company’s decision to break the joint venture with GAC.

https://news.google.com/__i/rss/rd/articles/CBMiXGh0dHBzOi8vd3d3LmNubi5jb20vMjAyMi8xMC8zMC9idXNpbmVzcy9zdGVsbGFudGlzLWNoaW5hLWpvaW50LXZlbnR1cmUtYmFua3J1cHRjeS9pbmRleC5odG1s0gEA?oc=5

2022-10-31 02:27:00Z

1633860207

Minggu, 30 Oktober 2022

Twitter Employees Expect Layoffs Under Elon Musk to Begin Shortly - Business Insider

This story is available exclusively to Insider subscribers. Become an Insider and start reading now.

- Musk formally acquired Twitter late Thursday and has yet to address his new staff.

- He and his transition team are said to be planning "aggressive" layoffs, likely to begin very soon.

- Twitter VPs are said to have worked since Friday to compile lists of who to keep.

Twitter employees expect Elon Musk to begin layoffs very soon because performance evaluations and code reviews have been progressing swiftly inside the company.

The billionaire closed on his deal to acquire Twitter late Thursday. Musk and his team, made up of people from his family office, Excession, and his personal lawyer Alex Spiro, along with some other Twitter leaders, are working on a transition of power this weekend at Twitter HQ in San Francisco.

Team leaders and vice presidents at Twitter started stack ranking employees late Friday, two people familiar with the process told Insider. This is a common type of performance review in tech where employees are compared to one another continued into Saturday.

By Saturday afternoon, the team leaders and VPs handed over lists of employees "to keep" to Musk and the team he has working with him to take over operations, the people said. They asked not to be identified discussing private matters. Representatives for Twitter did not respond to a request for comment on Saturday.

On Thursday and Friday, Musk also brought into the Twitter office several engineers from Tesla to undertake "code reviews," where Twitter engineers showed the code they'd been working on. They were even asked on Friday to "print out" their recent code so Musk could read it, a decision that was quickly reversed. Several engineering teams met with Tesla engineers.

Those meetings covered who among Twitter's engineers had made contributions and changes to code recently. The quality of those changes was also evaluated, and the "top" or best performers were identified, one of the people familiar with the process said. Overall, the point of the meetings and discussions was to "ask for who to cut, who to keep and what orgs are bad," this person added.

Similar overviews and conversations took place throughout the company on Friday, the other person said. There is no exact percentage of employees to be cut, this person added, but layoffs are expected to be "aggressive."

Given the pace at which the stack ranking happened, employees expect layoffs to begin very soon, both of the people familiar with the process said. The New York Times reported that job cuts could start as soon as Saturday.

Tuesday is the next equity vesting event at Twitter and, as the company is now private, this tranche of stock will convert automatically to cash. If employees get laid off on Monday, they could miss this vesting.

There's been little to no internal communication from Musk since his closed the acquisition late Thursday

Back in June, Musk met with Twitter workers and told them he would enact layoffs to improve the financial health of the company. On Wednesday, Musk spoke to employees who gathered around him at a company cafe. He was asked about a report by The Washington Post that his plan was to layoff 75% of the company, or about 6,000 people. "I don't know where that story came from," Musk said.

Are you a Twitter employee or someone with insight to share? Contact Kali Hays at khays@insider.com, on secure messaging app Signal at 949-280-0267, or through Twitter DM at @hayskali. Reach out using a non-work device.

https://news.google.com/__i/rss/rd/articles/CBMiaWh0dHBzOi8vd3d3LmJ1c2luZXNzaW5zaWRlci5jb20vdHdpdHRlci1lbXBsb3llZXMtZXhwZWN0LWxheW9mZnMtdW5kZXItZWxvbi1tdXNrLXRvLWJlZ2luLXNob3J0bHktMjAyMi0xMNIBAA?oc=5

2022-10-30 21:13:14Z

1617760416

Twitter Employees Expect Layoffs Under Elon Musk to Begin Shortly - Business Insider

This story is available exclusively to Insider subscribers. Become an Insider and start reading now.

- Musk formally acquired Twitter late Thursday and has yet to address his new staff.

- He and his transition team are said to be planning "aggressive" layoffs, likely to begin very soon.

- Twitter VPs are said to have worked since Friday to compile lists of who to keep.

Twitter employees expect Elon Musk to begin layoffs very soon because performance evaluations and code reviews have been progressing swiftly inside the company.

The billionaire closed on his deal to acquire Twitter late Thursday. Musk and his team, made up of people from his family office, Excession, and his personal lawyer Alex Spiro, along with some other Twitter leaders, are working on a transition of power this weekend at Twitter HQ in San Francisco.

Team leaders and vice presidents at Twitter started stack ranking employees late Friday, two people familiar with the process told Insider. This is a common type of performance review in tech where employees are compared to one another continued into Saturday.

By Saturday afternoon, the team leaders and VPs handed over lists of employees "to keep" to Musk and the team he has working with him to take over operations, the people said. They asked not to be identified discussing private matters. Representatives for Twitter did not respond to a request for comment on Saturday.

On Thursday and Friday, Musk also brought into the Twitter office several engineers from Tesla to undertake "code reviews," where Twitter engineers showed the code they'd been working on. They were even asked on Friday to "print out" their recent code so Musk could read it, a decision that was quickly reversed. Several engineering teams met with Tesla engineers.

Those meetings covered who among Twitter's engineers had made contributions and changes to code recently. The quality of those changes was also evaluated, and the "top" or best performers were identified, one of the people familiar with the process said. Overall, the point of the meetings and discussions was to "ask for who to cut, who to keep and what orgs are bad," this person added.

Similar overviews and conversations took place throughout the company on Friday, the other person said. There is no exact percentage of employees to be cut, this person added, but layoffs are expected to be "aggressive."

Given the pace at which the stack ranking happened, employees expect layoffs to begin very soon, both of the people familiar with the process said. The New York Times reported that job cuts could start as soon as Saturday.

Tuesday is the next equity vesting event at Twitter and, as the company is now private, this tranche of stock will convert automatically to cash. If employees get laid off on Monday, they could miss this vesting.

There's been little to no internal communication from Musk since his closed the acquisition late Thursday

Back in June, Musk met with Twitter workers and told them he would enact layoffs to improve the financial health of the company. On Wednesday, Musk spoke to employees who gathered around him at a company cafe. He was asked about a report by The Washington Post that his plan was to layoff 75% of the company, or about 6,000 people. "I don't know where that story came from," Musk said.

Are you a Twitter employee or someone with insight to share? Contact Kali Hays at khays@insider.com, on secure messaging app Signal at 949-280-0267, or through Twitter DM at @hayskali. Reach out using a non-work device.

https://news.google.com/__i/rss/rd/articles/CBMiaWh0dHBzOi8vd3d3LmJ1c2luZXNzaW5zaWRlci5jb20vdHdpdHRlci1lbXBsb3llZXMtZXhwZWN0LWxheW9mZnMtdW5kZXItZWxvbi1tdXNrLXRvLWJlZ2luLXNob3J0bHktMjAyMi0xMNIBAA?oc=5

2022-10-29 22:19:24Z

1617760416

With rising rates, which type of mortgage is best for you - Mortgage Matters - Castanet.net

Last Wednesday, the Bank of Canada increased its overnight benchmark interest rate 50 basis point to 3.75% from 3.25% in September.

That was the sixth time this year the bank tightened the money supply to quell inflation, so far with limited results.

Even though the increase was slightly less than what was predicted, the increase is still causing many pain and concern, particularly if they are currently in a variable rate or adjustable rate mortgage.

Even those with a fixed rate mortgage who are facing a renewal shortly will be looking at much higher rates if they have a five-year fixed term mortgage renewing.

Some of you may have received recommendations from your mortgage broker in the last couple of years to take a variable rate mortgage. This recommendation was based on not only historical data but also the outlook from the Bank of Canada itself.

This is what Tiff Macklem, the governor of the Bank of Canada had to say in October 2020: “What we’re saying is that we are going to get through this but it’s going to be a long slog. We’re telling Canadians, and our forward guidance has been very clear, that we are going to hold our policy interest rate at the effective lower bound until slack is absorbed so that we can sustainably achieve our 2% inflation target, and we’ve indicated that’s not going to happen until sometime into 2023. What does that mean? Yes, that means if you are a household considering making a big purchase, if you’re a business considering investing, you can be confident that interest rates will be low for a long time.”

There was no way for anyone to predict the current direction taken by the Bank of Canada.

So what action if any should you take going forward? You may be wondering if you should now lock-in your variable rate mortgage. There is lots of chatter in the media about the rate increasing again in December and again into next year.

The first question you should ask yourself is why you chose a variable rate mortgage in the first place. Was it because it had a lower rate than a fixed term mortgage or did you have a plan to take advantage of that lower interest rate?

Historically, a variable rate has been a better option by just comparing rates, but those rates can change. Potentially, and depending on whether you have a variable rate mortgage or an adjustable rate mortgage, more of your payment will go toward interest rather than principal if your payment isn’t adjusted accordingly as rates increase.

Another important consideration with variable rate mortgages is they have lower prepayment penalties generally than a fixed rate mortgage should you decide to break your mortgage early. Statistics support that this happens more often than not.

Consumers should evaluate their personal balance sheets and risk tolerance. The decision of whether to go short (variable) or long (fixed) will depend on the consumers’ tolerance for risk as well as their ability to withstand increases in mortgage payments.

You need a plan with a variable rate mortgage. The best thing is to do a review with a mortgage broker to determine your personal tolerance to rate increases and determine a strategy for managing your mortgage to reduce your overall cost of borrowing.

Something to consider about locking in your mortgage is that not all lenders are going to offer you the very best fixed rates. You are also hedging your bet that at some point your fixed rate is going to be lower than a variable rate mortgage.

Perhaps switching to a fixed payment variable might be an option rather than locking into a fixed term mortgage. The best decision is based on your risk tolerance.

No one can predict where rates are headed – even the experts got it wrong! You decision to lock-in to a fixed rate mortgage should not be based on what you read in the media.

If you would like a no obligation review and financial analysis for your personal situation please let me know. We can compare your current adjustable rate mortgage to a fixed term option and even compare it to a variable rate mortgage with fixed payments. That way you can make an informed decision as to whether locking in is the best option for you.

I will do my best to ensure you make the best decision based on today. Please book a time here on my calendar for a chat at www.calendly.com/april-dunn and I’ll do my best to assist.

This article is written by or on behalf of an outsourced columnist and does not necessarily reflect the views of Castanet.

https://news.google.com/__i/rss/rd/articles/CBMibmh0dHBzOi8vd3d3LmNhc3RhbmV0Lm5ldC9uZXdzL01vcnRnYWdlLU1hdHRlcnMvMzkzMjkzL1dpdGgtcmlzaW5nLXJhdGVzLXdoaWNoLXR5cGUtb2YtbW9ydGdhZ2UtaXMtYmVzdC1mb3IteW910gEA?oc=5

2022-10-29 18:00:00Z

1625106821

Sabtu, 29 Oktober 2022

What will Elon Musk do with Twitter? | Inside Story - Al Jazeera English

https://news.google.com/__i/rss/rd/articles/CBMiK2h0dHBzOi8vd3d3LnlvdXR1YmUuY29tL3dhdGNoP3Y9aHZYUGJGYUNwZzjSAQA?oc=5

2022-10-29 17:30:13Z

1617760416

The Dow soars, Big Tech tumbles: What's next for stocks as investors await Fed guidance - MarketWatch

The past week offered a tale of two markets, with gains for the Dow Jones Industrial Average putting the blue-chip gauge on track for its best October on record while Big Tech heavyweights suffered a shellacking that had market veterans recalling the dot-com bust in the early 2000s.

“You have a tug of war,” said Dan Suzuki, deputy chief investment officer at Richard Bernstein Advisors LLC (RBA), in a phone interview.

For the technology sector, particularly the megacap names, earnings were a major drag on performance. For everything else, the market was short-term oversold at the same time optimism was building over expectations the Federal Reserve and other major global central banks will be less aggressive in tightening monetary policy in the future, he said.

Read: Market expectations start to shift in direction of slower pace of rate hikes by Fed

What’s telling is that the interest-rate sensitive tech sector would usually be expected to benefit from a moderation of expectations for tighter monetary policy, said Suzuki, who contends that tech stocks are likely in for a long period of underperformance versus their peers after leading the market higher over the last 12 years, a performance capped by soaring gains following the onset of COVID-19 pandemic in 2020.

RBA has been arguing that there was “a major bubble within major portions of the equity market for over a year now,” Suzuki said. “We think this is the process of the bubble deflating and we think there’s probably further to go.”

The Dow

DJIA,

While it was a tough week for many of Big Tech’s biggest beasts, the tech-heavy Nasdaq Composite

COMP,

Big Tech companies lost more than $255 billion in market capitalization in the past week. Apple Inc.

AAPL,

Mark Hulbert: Technology stocks tumble — this is how you will know when to buy them again

Together, the five companies have lost a combined $3 trillion in market capitalization this year, according to Dow Jones Market Data.

Opinion: A $3 trillion loss: Big Tech’s horrible year is getting worse

Aggressive interest rate increases by the Fed and other major central banks have punished tech and other growth stocks the most this year, as their value is based on expectations for earnings and cash flow far into the future. The accompanying rise in yields on Treasurys, which are viewed as risk-free, raises the opportunity cost of holding riskier assets like stocks. And the further out those expected earnings stretch, the bigger the hit.

Excessive liquidity — a key ingredient in any bubble — has also contributed to tech weakness, said RBA’s Suzuki.

And now investors see an emerging risk to Big Tech earnings from an overall slowdown in economic growth, Suzuki said.

“A lot of people have the notion that these are secular growth stocks and therefore immune to the ups and downs of the overall economy — that’s not empirically true at all if you look at the history of profits for these stocks,” he said.

Tech’s outperformance during the COVID-inspired recession may have given investors a false impression, with the sector benefiting from unique circumstances that saw households and businesses become more reliant on technology at a time when incomes were surging due to fiscal stimulus from the government. In a typical slowdown, tech profits tend to be very economically sensitive, he said.

The Fed’s policy meeting will be the main event in the week ahead. While investors and economists overwhelmingly expect policy makers to deliver another supersize 75 basis point, or 0.75 percentage point, rate increase when the two-day gathering ends on Wednesday, expectations are mounting for Chairman Jerome Powell to indicate a smaller December may be on the table.

However, all three major indexes remain in bear markets, so the question for investors is whether the bounce this week will survive if Powell fails to signal a downshift in expectations for rate rises next week.

See: Another Fed jumbo rate hike is expected next week and then life gets difficult for Powell

Those expectations helped power the Dow’s big gains over the past week, alongside solid earnings from a number of components, including global economic bellwether Caterpillar Inc.

CAT,

Overall, the Dow benefited because it’s “very tech-light, and it’s very heavy in energy and industrials, and those have been the winners,” Art Hogan, chief market strategist at B. Riley Wealth Management told MarketWatch’s Joseph Adinolfi on Friday. “The Dow just has more of the winners embedded in it and that has been the secret to its success.”

Meanwhile, the outperformance of the Invesco S&P 500 Equal Weight ETF

RSP,

“Stepping back, this market and the economy more broadly are starting to remind me of the 2000-2002 setup, where extreme tech weakness weighed on the major indices, but more traditional parts of the market and the economy performed better,” he wrote.

Suzuki said investors should remember that “bear markets always signal a change of leadership” and that means tech won’t be taking the reins when the next bull market begins.

“You can’t debate that we’ve already got a signal and the signal is telling up that next cycle not going to look anything like the last 12 years,” he said.

https://news.google.com/__i/rss/rd/articles/CBMiiAFodHRwczovL3d3dy5tYXJrZXR3YXRjaC5jb20vc3Rvcnkvd2hhdC10aGUtZG93cy1zdGVsbGFyLW9jdG9iZXItYW5kLWJpZy10ZWNocy11Z2x5LXJvdXQtc2F5LWFib3V0LXRoZS1zdG9jay1tYXJrZXQtcmlnaHQtbm93LTExNjY3MDAyMjM50gEA?oc=5

2022-10-29 16:47:00Z

1627739755

Jumat, 28 Oktober 2022

Rising interest rates usher in a new era for savers: Dale Jackson - BNN Bloomberg

Judging by the news coverage of the latest Bank of Canada interest rate increase, you would think the world is about to end.

That may seem like the case for over-leveraged borrowers, but it’s a new dawn for retirement savers with nerve-wracking levels of exposure to volatile stock markets.

You need to go back over three decades to find a time when investment grade bonds did more of the heavy lifting in retirement portfolios; generating decent and reliable returns while lowering overall risk.

In that era, it was normal for investors in or nearing retirement to have a significant portion of their portfolios in fixed income.

That era could be returning.

A BRIEF HISTORY OF INTEREST RATES

This week’s 50-basis-point hike brings the Bank of Canada benchmark interest rate to 3.75 per cent from 0.25 per cent at the start of the year.

In a continuing effort to lower inflation, the central bank is expected to further hike its rate to 4.25 per cent, but that could change depending on how well it works.

While that may seem high by today’s standards, it is in line with the period between 1995 and the financial meltdown of 2008 when the world’s central banks had to slash rates to keep the system flowing.

From the 1980s to 1995, runaway inflation pushed the benchmark rate to just over 20 per cent, but from the 1950s to 1980 it remained in the six per cent range.

FIXED INCOME ENTERS THE SWEET SPOT

Fixed-income yields move up and down with the benchmark rate. At last check, Canada two-year bonds were paying 3.9 per cent compared with well under one per cent before the Bank of Canada started raising its rate.

At last check, one-year Guaranteed Investment Certificates (GICs) were yielding up to 4.85 per cent. If they move in tandem with expectations for another 50-basis-point increase, the yield on one-year GICs will reach 5.35 per cent.

Yields on longer-term government bonds, GICs and investment grade corporate bonds could rise faster as the economy stabilizes.

BUILDING A FIXED INCOME PORTFOLIO

That comes as cold comfort for retirement investors who have had to meet growth goals by venturing out on the risk ladder to find dividend income in tattered equity markets.

With stock markets down, now is not the time to sell to generate cash for fixed income.

Building a balanced portfolio between equities and fixed income takes time, and that’s where a qualified advisor can help trim equity holdings as stock markets recover and choose the best entry points in fixed income as rates rise.

Many would suggest “laddering” short-term maturities over time to create as many opportunities as possible to take advantage of the best yields as they increase.

INFLATION IS THE WILD CARD

The success of a fixed-income portfolio also depends on how effective the Bank of Canada is at getting inflation closer to its target of two per cent.

Those yummy yields could be eaten up by the cost of living.

Rates on GICs reached 9 per cent in the early 1980s, as an example, while inflation topped 11 per cent.

- Sign up to get breaking news email alerts sent directly to your inbox

This week’s lower-than-expected hike suggests it’s working. The latest reading on inflation shows the cost of living backed off to 6.9 per cent from over seven per cent in previous months.

The Bank of Canada also lowered its outlook on inflation to come in at 4.1 per cent in 2023 and 2.2 per cent in 2024.

Even in a best-case scenario, the real return on fixed income isn’t much, but finally having guaranteed income in retirement could let retirement savers sleep better at night.

https://news.google.com/__i/rss/rd/articles/CBMiZmh0dHBzOi8vd3d3LmJubmJsb29tYmVyZy5jYS9yaXNpbmctaW50ZXJlc3QtcmF0ZXMtdXNoZXItaW4tYS1uZXctZXJhLWZvci1zYXZlcnMtZGFsZS1qYWNrc29uLTEuMTgzODcyMNIBAA?oc=5

2022-10-28 12:16:09Z

1625106821

Elon Musk begins Twitter reign by firing CEO, top executives - Al Jazeera English

Tesla CEO kicks off tenure as social media giant’s new owner by firing top leadership.

Elon Musk has kicked off his tenure as the new owner of Twitter by giving the boot to the social media giant’s top leadership.

After closing a $44bn deal to buy the company on Thursday, Musk swiftly fired three of Twitter’s most senior executives in a signal of his intent to put his stamp on one of the world’s most influential social media platforms.

Chief Executive Parag Agrawal, Chief Financial Officer Ned Segal, and Vijaya Gadde, head of legal, policy and trust, were all shown the door, according to multiple media reports citing people familiar with the situation.

Sean Edgett, Twitter’s general counsel, was also given the sack, the Washington Post reported, citing an unnamed source.

Agrawal and Gadde were both reportedly escorted from Twitter’s San Francisco headquarters following Musk’s firing, Reuters reported, citing people familiar with the matter.

Twitter and Musk have yet to officially confirm the firings.

Musk, a self-described free-speech absolutist, had repeatedly clashed with the company’s leadership over their stewardship of the social media platform.

In April, the Tesla CEO tweeted a meme featuring Gadde’s face that suggested the platform’s moderation decisions are driven by left-wing bias.

Gadde has been a lightning rod for conservatives’ complaints about Big Tech’s censorship of their viewpoints. As Twitter’s top lawyer, the Indian-born executive made the decision to permanently suspend former United States President Donald Trump’s Twitter account over his alleged incitement of violence in the wake of the January 6 riots at the US Capitol.

In May, Musk publicly clashed with Agrawal, tweeting a faeces emoji in response to a thread by the Twitter CEO that argued it was not possible to determine the true number of spam accounts on the platform. The exchange came after Musk attempted to back out of his $44bn deal to buy the company after accusing executives of concealing the number of bots and spam accounts on the platform.

Text messages made public during Twitter’s legal bid to enforce the original terms of the deal revealed terse exchanges between the two men over the direction of the company.

Before taking over from Twitter founder Jack Dorsey last year, Agrawal, who moved from Mumbai to the US in 2005, served as chief technology officer. In an interview with MIT Technology Review in 2020, he said he viewed the company’s role as to “focus less on thinking about free speech, but thinking about how the times have changed”.

In court documents filed earlier this month, Musk’s lawyers accused senior executives including Agrawal, Gadde and Edgett of directing Twitter whistleblower Peiter Zatko to destroy evidence of the company’s subpar cybersecurity policies.

While Musk’s exact plans for Twitter are not yet clear, the billionaire has criticised the platform’s moderation policies and stressed the need for a “common digital town square” where a wide range of views can be discussed.

Critics have warned that Musk’s takeover of Twitter could result in a surge in hate speech and misinformation, while conservatives have welcomed his purchase as a corrective to what they see as Silicon Valley’s stranglehold on political discussion online.

https://news.google.com/__i/rss/rd/articles/CBMiaGh0dHBzOi8vd3d3LmFsamF6ZWVyYS5jb20vZWNvbm9teS8yMDIyLzEwLzI4L211c2stYmVnaW5zLXR3aXR0ZXItcmVpZ24tYnktZ2l2aW5nLXRvcC1leGVjdXRpdmVzLXRoZS1ib2900gFsaHR0cHM6Ly93d3cuYWxqYXplZXJhLmNvbS9hbXAvZWNvbm9teS8yMDIyLzEwLzI4L211c2stYmVnaW5zLXR3aXR0ZXItcmVpZ24tYnktZ2l2aW5nLXRvcC1leGVjdXRpdmVzLXRoZS1ib290?oc=5

2022-10-28 08:39:56Z

1617760416

Elon Musk takes over Twitter in $44bn deal - Al Jazeera English

Tesla CEO’s purchase caps a six-month saga over the future of the social media giant.

Elon Musk has officially taken control of Twitter after finalising a $44bn deal to buy the social media network.

In one of his first decisions at the helm of the social media giant, Musk, the world’s richest man, fired three top executives including CEO Parag Agrawal, multiple United States-based media outlets reported on Thursday, citing people familiar with the matter.

Chief Financial Officer Ned Segal and Vijaya Gadde, head of legal, policy, and trust, were also let go, according to the reports.

Sean Edgett, Twitter’s general counsel, was also fired, the Washington Post reported, citing an unnamed source.

Following the reports, Musk tweeted “the bird is freed”, referencing the social media network’s bird logo.

Musk and Twitter have yet to confirm the firings.

The Tesla CEO’s purchase caps a six-month saga that saw Twitter initially resist Musk’s purchase offer and then sue the billionaire after he signalled he would nix the deal over concerns about spam accounts and whistleblower claims about lax cybersecurity practices.

Musk’s interest in the platform has become a lightning rod for the debate around free speech in the digital age. Critics have expressed concerns that Musk’s reign could mean open slather for hate speech and misinformation, while many conservatives have heralded the takeover as a corrective to Big Tech censorship of politically incorrect views.

Musk, who describes himself as a “free speech absolutist”, has criticised Twitter’s moderation policies and objected to censorship that goes beyond the requirements of the law. In May, Musk said he would reinstate former US President Donald Trump’s Twitter account, which was removed for allegedly inciting violence in the wake of the January 6 riots at the US Capitol.

Musk has also expressed discomfort with the platform’s reliance on advertising and is widely anticipated to oversee significant job cuts at the company, although he has reportedly denied a Washington Post report suggesting he plans to slash 75 percent of the workforce.

In a lengthy message posted on Twitter before the purchase deadline on Friday, Musk, who earlier changed his Twitter bio to “Chief Twit”, denied any intention to turn the platform into a “free-for-all hellscape”.

“The reason I acquired Twitter is because it is important to the future of civilization to have a common digital town square, where a wide range of beliefs can be debated in a healthy manner, without resorting to violence,” he said.

Musk, who has cast himself as a moderate, regularly weighs in on politics and has attracted criticism with unorthodox proposals for handling geopolitical flashpoints ranging from Taiwan to Ukraine.

The billionaire earlier this year announced he would vote Republican in upcoming elections as the Democrats had become the “party of division and hate”, but later said he supported moderate candidates from both parties.

https://news.google.com/__i/rss/rd/articles/CBMiVmh0dHBzOi8vd3d3LmFsamF6ZWVyYS5jb20vZWNvbm9teS8yMDIyLzEwLzI4L2Vsb24tbXVzay10YWtlcy1vdmVyLXR3aXR0ZXItaW4tNDRibi1kZWFs0gFaaHR0cHM6Ly93d3cuYWxqYXplZXJhLmNvbS9hbXAvZWNvbm9teS8yMDIyLzEwLzI4L2Vsb24tbXVzay10YWtlcy1vdmVyLXR3aXR0ZXItaW4tNDRibi1kZWFs?oc=5

2022-10-28 01:39:18Z

1617760416

Kamis, 27 Oktober 2022

Meta shares fall to lowest level since 2016 as Big Tech wipeout continues - CBC News

Shares in the company formerly known as Facebook lost more than 20 per cent of their value on Thursday morning, after the social media company posted quarterly results that showed its core business is slowing even as it's spending billions of dollars trying to become a leader in the metaverse.

Meta reported Wednesday that it took in $27 billion US in revenue last quarter, down from $29 billion previously. That's two straight quarters of declining revenue and the company is forecasting the same to happen in the current one, which was enough to send investors running for the exits.

Meta shares were changing hands at just above $100 a share on Thursday morning, a level they haven't seen since 2016. As recently as February they were worth more than $300 apiece, enough to make the company one of only a handful in the world with a $1 trillion valuation.

The company was once an advertising colossus, but in recent months financial results show upstart rivals like video-sharing website TikTok are monopolizing an increasing number of the eyeballs that once belonged to Facebook or its other service, Instagram.

It was roughly this time a year ago that the company, then known as Facebook Inc. rebranded itself as Meta to showcase its belief that its future lies in the metaverse, a virtual, mixed and augmented reality universe that exists entirely online.

WATCH | What is the Metaverse and why is Facebook jumping into it?

Facebook rebrands, reveals plan to focus on metaverse

A year later, the company has spent billions of dollars on the metaverse experiment with very little of substance to show for it.

The company's metaverse-focused unit, called Reality Labs, took in $285 million in revenue during the quarter. But it posted an operating loss of $3.87 billion. It expects that number to get even bigger next year.

Investors are concerned Meta is spending too much money and confusing people with its focus on the metaverse, a concept users don't yet understand or seem to want — at a time when its other cash cows are starting to dry up.

Richard Lachman, an associate professor at Toronto Metropolitan University, says the company has pushed aggressively into things like expensive virtual reality headsets because they need a "killer app" to drive people into their version of the metaverse

"The adoption has not been huge," he told CBC News in a recent interview. "Lots of people have maybe tried a game or entertainment, but it's not leading to massive sales."

Brad Gerstner, the CEO of Meta shareholder Altimeter Capital, penned an open letter to CEO Mark Zuckerberg earlier this week urging the company to forget about their metaverse experiment, and refocus on their core business.

"Meta has drifted into the land of excess — too many people, too many ideas, too little urgency," he wrote, urging the company to reduce staffing levels and cut costs. "This lack of focus and fitness is obscured when growth is easy but deadly when growth slows and technology changes."

'An absolute train wreck'

Facebook isn't the only tech giant to see its shares fall off in recent months, but the depth of its plunge has been far in excess of what other companies have seen.

Google shares have lost 35 per cent in the past year, while Microsoft is down by 29 per cent. Over that same period, Meta shares have lost more than 65 per cent of their value.

Daniel Ives, a technology analyst with Wedbush Securities, who covers all the big tech names, called the company's financial results "an absolute train wreck."

"The company is facing ... privacy issues, massive digital media headwinds, social media share losses, and transforming its business model at the worst possible time with Zuckerberg needing to lead through this perfect storm," he said.

Insider Intelligence analyst Debra Aho Williamson said the company was once seen as a trailblazer, but that is no longer the case.

"As Facebook Inc., it was a revolutionary company that changed the way people communicate and the way marketers interact with consumers," she said. "Today it's no longer that innovative groundbreaker."

https://news.google.com/__i/rss/rd/articles/CBMiTGh0dHBzOi8vd3d3LmNiYy5jYS9uZXdzL2J1c2luZXNzL21ldGEtZmFjZWJvb2stenVja2VyYmVyZy10cm91Ymxlcy0xLjY2MzExOTjSAQA?oc=5

2022-10-27 16:33:35Z

1627097335

Why the rout for big tech companies may just be getting started - MarketWatch

Wall Street isn’t looking at a too-terrible day ahead, when you strip out tech that is.

Late Wednesday was another cold, wet blanket for investors as Facebook parent Meta Platforms added its own ugly results to a gloomy pile of tech earnings. Margin pressure and weak ad demand may bode poorly for two more big names coming after Thursday’s closing bell.

“The recent price hikes announced by Apple should mitigate some of the expected weakness in the outlook, while Amazon will face triple pressure points in its e-commerce, advertising, and cloud business,” cautions Saxo Bank strategists.

We are staying on hot-button tech in our call of the day, which indicates it may be too soon to go dip buying in the sector, because the worst may not be over.

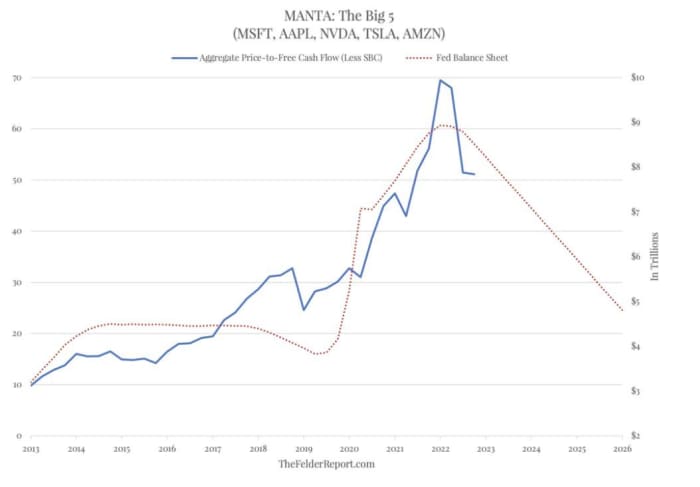

The Felder Report blog’s Jesse Felder, says if you combine market caps of Microsoft

MSFT,

“This historic level of overvaluation was only made possible by massive money printing on the part of the Fed that supported both cash flows and the multiple applied to them,” Felder writes. “Now that inflation is raging, however, the money printer has been shifted into reverse and that’s already having a visible impact.”

His below chart is a consolidation of that reversal in valuations and falling liquidity:

The chart shows just how bad tech valuation could get, if it tracks the red dotted line representing Fed normalizing its balance sheet for the next few years. Thus, that valuation reversion could just be getting started, while price-to free cash flow ratios could see another 50% drop from current levels, said Felder.

A reversal in free cash flow would make the situation even more painful, he says. “Worryingly, that reversal in cash flows is actually what has happened over the past year in which growth went from double digits positive to double digits negative.”

Felder warned in April that given the pandemic and ensuing stimulus, it’s possible there was a “significant pulling forward of demand for Big Tech products and services that will now leave a vacuum of demand for a prolonged period of time.”

He says we are starting to see what that might look like, with a Fed-induced recession unlikely to help.

The markets

U.S. stocks

DJIA,

The buzz

Meta shares

META,

Opinion: Facebook and Google grew into tech titans by ignoring Wall Street. That could lead to their downfall

Upbeat results have lifted shares of Caterpillar

CAT,

And after the close, in addition to Apple and Amazon.com, Intel

INTC,

The European Central Bank has made another jumbo 75-basis poin rate hike, as largely expected. A decision is due at 8:15 a.m. Eastern, followed 30 minutes later by President Christine Lagarde’s press conference.

Housing slowdown hits real-estate service group Zillow

Z,

A first look at third-quarter GDP showed a stronger-than-expected rise of 2.6%, above the 2.3% gain economists expected. Other data showed durable goods orders rising 0.4% in September. The latest weekly initial jobless claims data showed a 3,000 gain to 217,000. .

Elon Musk, facing a Friday deadine to complete his $44 billion Twitter

TWTR,

Ford

F,

Credit Suisse

CS,

Best of the web

The war in Ukraine could hasten along cleaner energy, says a new report.

These Americans live with ghosts.

Global warming sees Bangldesh farmers revive a 200-year old technique

Yale professor predicts how the war in Ukraine will end

The chart

How surprising have tech earnings been? Check out this tweet by the Tao of Trading founder Simon Ree:

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security name |

|

META,

| Meta Platforms |

|

TSLA,

| Tesla |

|

GME,

| GameStop |

|

MULN,

| Mullen Automotive |

|

NIO,

| NIO |

|

AMC,

| AMC Entertainment |

|

AAPL,

| Apple |

|

BBBY,

| Bed Bath & Beyond |

|

MSFT,

| Microsoft |

|

TWTR,

|

Random reads

TikTok “Kia challenge” involving stealing a car leaves four teens dead.

Pope says online porn is a dangerous vice, and even nuns are doing it.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

https://news.google.com/__i/rss/rd/articles/CBMieGh0dHBzOi8vd3d3Lm1hcmtldHdhdGNoLmNvbS9zdG9yeS93aHktdmFsdWF0aW9uLXJldmVyc2Fscy1mb3ItYmlnLXRlY2gtY29tcGFuaWVzLW1heS1qdXN0LWJlLWdldHRpbmctc3RhcnRlZC0xMTY2Njg2NzU4MtIBAA?oc=5

2022-10-27 10:46:00Z

1627875672

Global National: Oct. 26, 2022 | What Bank of Canada's latest interest rate hike could mean - Global News

https://news.google.com/__i/rss/rd/articles/CBMiK2h0dHBzOi8vd3d3LnlvdXR1YmUuY29tL3dhdGNoP3Y9SzVzMHBBUVpkNDDSAQA?oc=5

2022-10-27 01:53:21Z

1625106821

Rabu, 26 Oktober 2022

Clorox recalls some Pine-Sol products in Canada and U.S. - CTV News

U.S.–based Clorox is recalling a number of its Pine-Sol brand cleaning products in Canada.

The company says several sizes of Pine-Sol Multi-Surface Cleaner in scents of Lavender Clean, Lemon Fresh and Mandarin Sunrise could contain bacteria and should not be used. Out of an abundance of caution the company issued the recall and customers that have products can be reimbursed.

Pine-Sol is directing customers to check for the UPC and date codes on its website to confirm the recall impacts the product. The UPC code is found next to the barcode on the product. The date is printed in black near the top of the bottom and starts with A4 followed by five numbers. Impacted products will have a date code with the first five digits 22249 or lower.

Original Pine-Sol Multi-Surface Cleaner in Pine scent, Spring Blossom and Rainforest Dew, which are sold in Canada, are not part of the recall.

Consumers with recalled items can apply for a reimbursement on the Pine-Sol website and can expect a return of the product plus tax within four to six weeks. The company is asking customers to take a photo of both the UPC code and date to prove their product is part of the recall.

The bacteria is an environmental organism found in soil and water and is called Pseudomonas aeruginosa. People with weakened immune systems or external medical devices can risk infection if the bacteria is inhaled. The company says that people with “healthy immune systems” are usually not affected by the bacteria.

https://news.google.com/__i/rss/rd/articles/CBMiaWh0dHBzOi8vd3d3LmN0dm5ld3MuY2EvaGVhbHRoL3BpbmUtc29sLWNsZWFuaW5nLXByb2R1Y3RzLXJlY2FsbC1pbi1jYW5hZGEtd2hhdC15b3UtbmVlZC10by1rbm93LTEuNjEyNTc4MdIBAA?oc=5

2022-10-26 16:01:00Z

1626689001

Musk signals $44 billion Twitter deal on track to close this week - Ars Technica

Elon Musk has confirmed on a video call with his advisers that he intends to close his $44 billion acquisition of Twitter on Friday, potentially bringing an end to the turbulent acquisition process, according to people briefed about the matter.

In another sign that the deal will close by the end of the week, Musk’s lawyers at Skadden, Arps, Slate, Meagher & Flom sent paperwork to equity investors in the deal, according to two investors and a person close to the Tesla boss.

A group of banks led by Morgan Stanley, which includes Bank of America and Barclays, committed $13 billion in financing for the deal back in April. Meanwhile, Musk has raised at least $7 billion for his bid from a roster of equity investors including Oracle co-founder Larry Ellison, Saudi Prince Alwaleed bin Talal, and asset management groups Fidelity, Brookfield, and Sequoia Capital.

Confirmation from Musk that he intends to close the deal will come as a relief to Twitter shareholders concerned that the billionaire, who has repeatedly tried to find a way to walk away from the deal, would seek to find a last-minute reason to abandon the transaction.

Twitter shares rose 2.7 percent to $52.92 on the news, the highest they have traded since Musk agreed to pay $54.20 a share to buy the company in April.

Large hedge funds, including DE Shaw, betting on the deal’s completion, have been adding to their positions ahead of Friday’s expected closing.

One told the Financial Times it added to its position after a report from Bloomberg that US officials were discussing whether they could review the deal under national security grounds—which the White House later denied—sent shares tumbling. The fund bought more than 200,000 shares at an average price below $50 per share during a sell-off last Friday. “Once it closes, I will be happy,” said the hedge fund manager.

Several months after agreeing to buy Twitter, Musk, who had waived due diligence to buy the platform, said he was terminating the deal, citing concerns over fake accounts and cyber security. Twitter sued Musk in a bid to compel him to close.

This month, Musk and Twitter’s legal fight was due to go to trial in Delaware Chancery Court. However, in the face of mounting legal pressure, Musk capitulated, saying he was willing to buy the company at the originally agreed price if the legal action was dropped.

Twitter resisted an immediate resolution, pointing to a deep mistrust of Musk, but the court then ordered the parties to find a way to close the deal by October 28 or face a November trial.

One person familiar with Twitter’s thinking said the company also expected the deal to close on Friday. Bloomberg first reported news of Musk’s call with advisers on Tuesday. A CNBC journalist first reported that equity investors had received paperwork from Musk’s lawyers.

Twitter declined to comment. A representative for Musk did not immediately respond to a request for comment.

Additional reporting by Richard Waters in San Francisco and Arash Massoudi in London.

© 2022 The Financial Times Ltd. All rights reserved. Not to be redistributed, copied, or modified in any way.

https://news.google.com/__i/rss/rd/articles/CBMibWh0dHBzOi8vYXJzdGVjaG5pY2EuY29tL3RlY2gtcG9saWN5LzIwMjIvMTAvbXVzay1zaWduYWxzLTQ0LWJpbGxpb24tdHdpdHRlci1kZWFsLW9uLXRyYWNrLXRvLWNsb3NlLXRoaXMtd2Vlay_SAXNodHRwczovL2Fyc3RlY2huaWNhLmNvbS90ZWNoLXBvbGljeS8yMDIyLzEwL211c2stc2lnbmFscy00NC1iaWxsaW9uLXR3aXR0ZXItZGVhbC1vbi10cmFjay10by1jbG9zZS10aGlzLXdlZWsvP2FtcD0x?oc=5

2022-10-26 13:26:41Z

1617760416